Exhaustion Pattern Trade

The Exhaustion pattern trade is meant to call a market top and a market bottom. The trade following is your opportunity to buy in at the test of the low. It is even more powerful when combined with the ZoneTraderPro filters. The trade is further confirmed with a chart of the 10 year bonds with ZoneTraderPro applied.

This Exhaustion pattern trade is setup very nicely by a TICK divergence of 200. The previous low was -627 and at the area of the trade is was only -428. Additionally the Euro trade filter was moving in the favor of the trade. The risk on this trade was 4 ticks, and the market never moved against the trade. The maximum favorable excursion was 4.5 points.

The trade also illustrates the use of the TICK filter and the trend trade. There was a trend trade which immediately followed the exhaustion trade pattern. However as the market price dropped to the entry point the TICK low was 78 lower than the previous low, thus the trade was filtered out. You can set this filter to a higher number than the default zero, once you become familiar with the filter and the patterns.

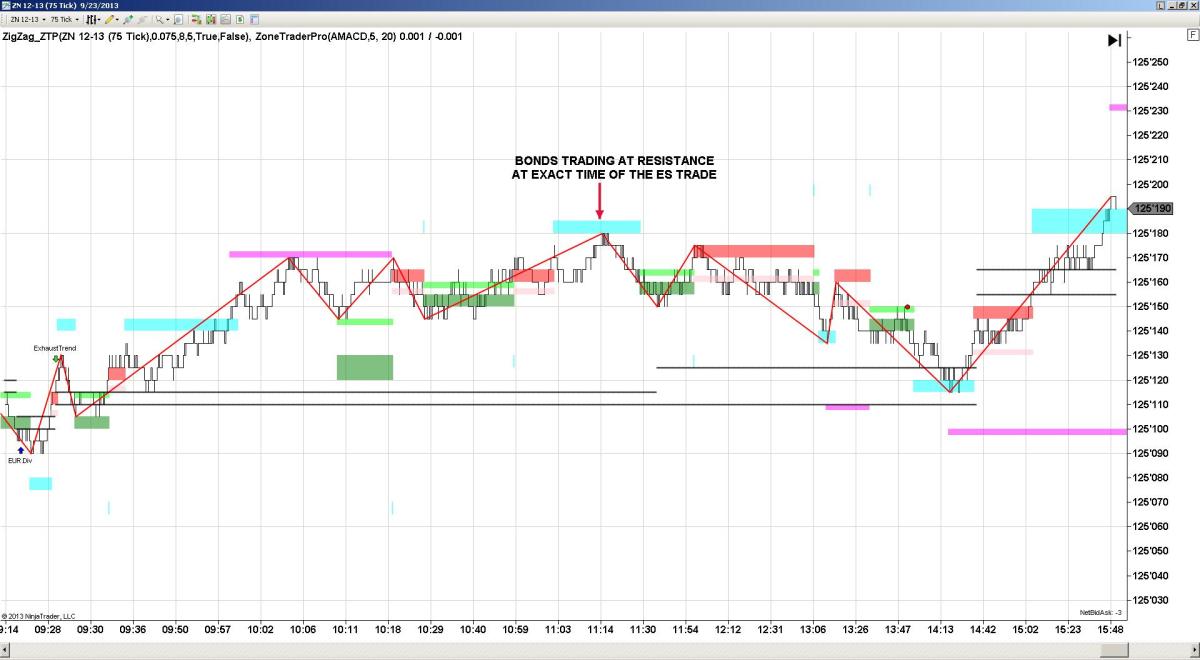

Bond Chart Trade Pattern

The bond charts had setup perfectly to confirm this trade. As you can see from the chart, the bonds touch resistance just as the long ES exhaustion trade pattern is being indicated. Notice how the Bonds price is very accurately contained in the support and resistance of the software after the trade. These setups occur every day, but without ZoneTraderPro you do not know what these price levels of support and resistance are.